|

The importance of not taking yourself (and your job) too seriously cannot be overstated. If you don't laugh about what we are called to do, you will burn out. Repeat: You will burn out. One of my favorite ways to motivate the staff and get everyone giggling was to take popular memes and make them specific to whatever was the big project for our office at the time. When we launched our first day of giving campaign, the Southern Miss Gold Rush, I did a series of these that were just for us in the office. One is above. Here are a few more. These memes worked because in the back of everyone's mind when you launch a new project is "How much extra work is this going to cause me?" Right? So, let's make fun of that together and it makes it easier to get through the day. At the very least, everyone can laugh at me for sharing such silly memes via office email.

We loved Grumpy Cat at my last office because our Vice President for Advancement was notoriously for his pessimism, earning him the title of Grumpy Cat. We even got him a cake on his birthday! Epic!! So, lighten up and make your colleagues laugh a little. Otherwise you might end up with a birthday cake like this! One of my most favorite techniques for improving caller motivation is to write letters to local businesses to ask for “gifts-in-kind” to use as prizes for outstanding callers. That idea is far from new, but there is one tweak that I think many haven’t thought of that makes all the difference in terms of success.

Many universities and colleges commission economic impact studies that quantify the value that these higher educational institutions have on their local economies. These studies usually herald impressive numbers, from the number of jobs provided by the university to the total estimated dollars of economic impact. Here are a few examples to show you what you’re looking for:

If you can get your hands on a study like this specific to your institution, you will be able to craft a letter that is optimally successful. Some studies have a statistic that actually shows how much money university students spend in the local marketplace, like the ones from Notre Dame and South Carolina above. If you can get this figure, it’s clutch. The data from these sorts of studies will motivate the businessperson to get their business more in front of students. They will see what a significant portion of their business that students (and the university in general) represents. And you will be providing them with a quick and easy way to advertise to students. All they need to do is provided a few coupons for free merchandise or services and you will not only put them on your webpage or Facebook (or both) but you’ll give these out only to the top performers so they get to try their products. To find an economic impact study for your institution, start just by googling “economic impact study” and your institution’s name. If nothing comes up, contact the College of Business or Economic Development department at your institution and they may know of a study or where to find it. Some universities do a great job of promoting this important information and others don't exactly. It may be hidden away in some office of institutional research. Put it to good use. Do you solicit “gifts-in-kind” from local business for your phonathon? If you have a killer letter that you use, please share the text in the comments! I'm a HUGE Michael Phelps fan. When I did my recent post about "Be Like Mikhail!" it could very easily have been about "Be Like Michael!" instead. He is a similar inspiration in terms of excellence.

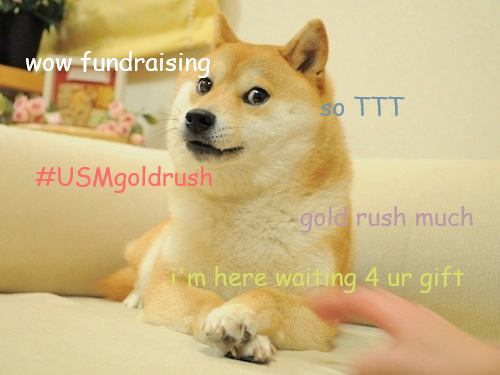

If you haven't been following the Olympics, one of Michael Phelps' opponents was trying to annoy him and psych him out before a race and his response was a facial expression to rival Grumpy Cat! Who knows whether he was just in the zone, truly annoyed or just doing isometric warm-ups, but it set the internet on fire for a while. An informal caption contest was raging with the hastag #Phelpsface. Anyway, I was a bit inspired and create a number of non-profit and fundraiser things that make me go #Phelpsface. Here's the collection for your Friday laugh: When you're an annual fund person interviewing for a #majorgift position and they like you but think you don't know how to #ask. #phelpsface When people ask you if plan on working in #phonathon forever. As if you have a #calling for it. #PhelpsFace #telefund #punny When you hear "all we need to worry about is #donorretention. This year we're cutting the budget for acquisition." #PhelpsFace #fundraising When someone uses 5 different fonts and 3 different styles of bullets in one document. #Phelpsface #graphicstandards #pleasenocomicsans When it's 20 mins after the meeting start time and the Skype call hasn't started. #PhelpsFace #nonprofit #fundraising When somebody suggest not calling #youngalumni because "they have too much #studentloan debt. #PhelpsFace #phonathon http://bit.ly/2aKm9NZ When a manager doesn't require 3 asks for callers, they trust them to do their job. #PhelpsFace #telefund #phonathon http://bit.ly/2bpP2U5 When leadership says they need annual giving to cut the budget 10% but bring in 20% more funds. #PhelpsFace #annualgiving #fundraising When it's 4 weeks into calling, your manager shows up and the seats are half empty. #PhelpsFace #phonathon #telefund http://bit.ly/2bovCuE When administrators want to shut down #phonathon calling because of three complaints. #PhelpsFace #fundraising #telefund When people say, "all fundraising will be done with QR codes in the future." #PhelpsFace #fundraising When you tell someone you work at the #phonathon and the reply is, "so you're a telemarketer." #PhelpsFace #fundraising When you're at a conference and someone says, "Direct mail is dead you know." #PhelpsFace #fundraising When you send an email about a thing you need today and get and "out-of-office" reply. They'll be back in two weeks. #PhelpsFace #nonprofit When you sent save-the-dates and invites (email and mail) and a board member says, "oh, I didn't know about it." #PhelpsFace #nonprofit If you're not familiar with the film, Office Space, get thee to your Netflix list and order it up straightaway. Anyone who works in an office must see this movie because it not only provides catharsis for the modern worker (there's scene where the characters destroy an evil printer), it gives us perfect metaphors to describe what we don't like about our work. You see, I'm a fundraiser. I am focused on all things forward and outward. As a consequence, I am terrible at getting my expense reports done on time. Expense reports are important and I realize this but I cannot seem to get them done on time! This causes some problems for the accounting staff. The photo above is my "punishment" for one of the times that I turned my monthly expense report in 11 days late. I tried to look as remorseful as possible. We called the expense reports "TPS reports" because they had to be done in a certain, specific way and the fundraisers always seemed to be getting it wrong. So, even if it was done on time, you usually had to modify somehow to get it right after turning it in the first time. So, for your Friday fun and entertainment, I give you the Office Space scene RE: TPS Reports. Enjoy!  For those of us working in higher education fundraising, the issue of student debt has an increasing amount of relevance. The Project on Student Debt through the Institute for College Access and Success writes, “Over the last decade—from 2004 to 2014—the share of graduates with debt rose modestly (from 65% to 69%) while average debt at graduation rose at more than twice the rate of inflation.” How can we expect our young alumni to give back to our institutions when they can barely make their loan payments? Many in society are questioning whether a college education is good investment and the view of college is shifting to one that is transactional, rather than transformational. Not only should advancement professionals stay up-to-speed on these issues because of how it may affect the way young alumni give (or don’t give), but we should also utilize this as an opportunity to put out positive messages about how philanthropy can mitigate this situation for scholarship recipients. There are great resources available that track this information. The organization cited above (The Project on Student Debt) collects data from most colleges and universities and reports it online. You can access overall statistics, historical trends as well as data by state and by institution. With a little bit of research time, you can learn how your institution compares with peer institutions and with other institutions in your state. You can also see how the trends have change over time. The historical reports are a bit more difficult to find so here are links to the reports for 2011, 2012 and 2013. 2011: http://ticas.org/content/pub/student-debt-and-class-2011 2012: http://ticas.org/content/pub/student-debt-and-class-2012 2013: http://ticas.org/sites/default/files/legacy/fckfiles/pub/classof2013.pdf Another great resource for geeks like me is this interactive graph from the New York Times. I love this resource because it lets you see how the trends with student debt change across time and you can see how the cost of tuition has risen. You can break it down by all different kinds of criteria. For instance, here’s the some data for the Southeastern Athletic Conference for 2004 (top graph): Notice how low nearly all of the schools are in terms of both cost and student debt (blue dots). The only outlier is Vanderbilt (orange dot), which had slightly higher debt loads but was much more expensive. The expense is not surprising since it’s the only private school in the SEC. Now take a look at the 2nd graph. It’s the same data for the same schools 6 years later. At the University of Georgia in 2004, the annual tuition was only a bit more than $4,000 and the student debt was around $13,000. By 2010, tuition at UGA was over $7,500 and the average amount of student debt was now almost $16,000. There’s a totally different story at Vandy and it’s completely counterintuitive. In 2004, the average Vandy grad carried over $24,000 in student loans. The cost of an education was almost $28,000. The cost to attend Vandy rose to over $38,000 in 2010, but the average amount of student debt DECREASED to $18,600. How could this be? The answer is obvious: philanthropy. Vandy must have raised and awarded more scholarship during this 6-year period. So, charitable giving can make a marked difference in the future of an average student where debt is concerned. Why are we not writing this into each single phonathon script and direct mail piece that we produce in higher education fundraising? I encourage you to play around with these tools and do some research into the trends at your own institution. You can then build statistically relevant objection responses for alumni who say they cannot give due to student loan debt loads and more importantly you can more effectively market the potential positive impact that major donors can have when they make a gift for scholarships. |

Jessica Cloud, CFREI've been called the Tasmanian Devil of fundraising and I'm here to talk shop with you. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed