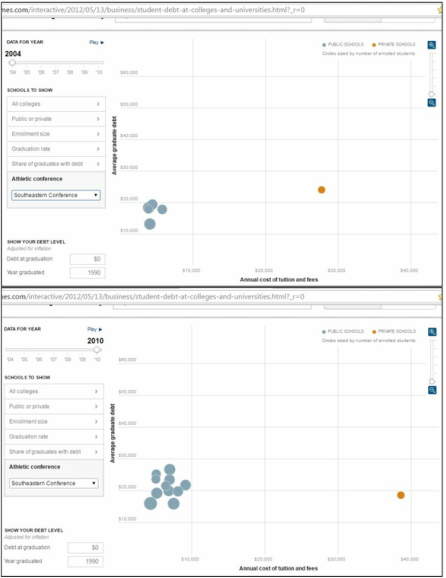

For those of us working in higher education fundraising, the issue of student debt has an increasing amount of relevance. The Project on Student Debt through the Institute for College Access and Success writes, “Over the last decade—from 2004 to 2014—the share of graduates with debt rose modestly (from 65% to 69%) while average debt at graduation rose at more than twice the rate of inflation.” How can we expect our young alumni to give back to our institutions when they can barely make their loan payments? Many in society are questioning whether a college education is good investment and the view of college is shifting to one that is transactional, rather than transformational. Not only should advancement professionals stay up-to-speed on these issues because of how it may affect the way young alumni give (or don’t give), but we should also utilize this as an opportunity to put out positive messages about how philanthropy can mitigate this situation for scholarship recipients. There are great resources available that track this information. The organization cited above (The Project on Student Debt) collects data from most colleges and universities and reports it online. You can access overall statistics, historical trends as well as data by state and by institution. With a little bit of research time, you can learn how your institution compares with peer institutions and with other institutions in your state. You can also see how the trends have change over time. The historical reports are a bit more difficult to find so here are links to the reports for 2011, 2012 and 2013. 2011: http://ticas.org/content/pub/student-debt-and-class-2011 2012: http://ticas.org/content/pub/student-debt-and-class-2012 2013: http://ticas.org/sites/default/files/legacy/fckfiles/pub/classof2013.pdf Another great resource for geeks like me is this interactive graph from the New York Times. I love this resource because it lets you see how the trends with student debt change across time and you can see how the cost of tuition has risen. You can break it down by all different kinds of criteria. For instance, here’s the some data for the Southeastern Athletic Conference for 2004 (top graph): Notice how low nearly all of the schools are in terms of both cost and student debt (blue dots). The only outlier is Vanderbilt (orange dot), which had slightly higher debt loads but was much more expensive. The expense is not surprising since it’s the only private school in the SEC. Now take a look at the 2nd graph. It’s the same data for the same schools 6 years later. At the University of Georgia in 2004, the annual tuition was only a bit more than $4,000 and the student debt was around $13,000. By 2010, tuition at UGA was over $7,500 and the average amount of student debt was now almost $16,000. There’s a totally different story at Vandy and it’s completely counterintuitive. In 2004, the average Vandy grad carried over $24,000 in student loans. The cost of an education was almost $28,000. The cost to attend Vandy rose to over $38,000 in 2010, but the average amount of student debt DECREASED to $18,600. How could this be? The answer is obvious: philanthropy. Vandy must have raised and awarded more scholarship during this 6-year period. So, charitable giving can make a marked difference in the future of an average student where debt is concerned. Why are we not writing this into each single phonathon script and direct mail piece that we produce in higher education fundraising? I encourage you to play around with these tools and do some research into the trends at your own institution. You can then build statistically relevant objection responses for alumni who say they cannot give due to student loan debt loads and more importantly you can more effectively market the potential positive impact that major donors can have when they make a gift for scholarships. Comments are closed.

|

Jessica Cloud, CFREI've been called the Tasmanian Devil of fundraising and I'm here to talk shop with you. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed