Did you get at least 2 good ideas to pursue from this list? Which one was most helpful? Do you have any tips for my readers struggling to make their direct mail copy fresh? Comments and questions are, as always, welcomed and encouraged! Best of luck in your copywriting! Cheers, Jessica Cloud PS – I TOLD YOU EVERYONE READS THE PS! If you liked this post, you might also like these:

PPS - If you found this article helpful, please comment and let me know. Also subscribe to Real Deal Fundraising so you don't miss a post! You'll get my guide to Call Center Games for Free! I’ve talked about finding the stories of impact and sharing them with your donors. The importance of letting donors see how their gifts have transformed lives cannot be overstated.

Upon reflection, I realized that I have overlooked throughout my entire career, one very important story: my own. I have searched for the stories of scholarship recipients at every institution I’ve worked for and totally forgot to be recognize the impact donors have had on my own journey. I was lucky enough to have been awarded a 4-year leadership scholarship which covered my room and board at my alma mater, The University of Southern Mississippi, but I was also the recipient of a generous scholarship so that I could go to London one summer for study abroad. The Dean of the Honors College also sent me on two trips (one to Princeton and one to Washington, D.C.) using funds that I now know must have been generated from Annual Fund gifts. I also know that charitable donations helped to support the fantastic Honors Forum series that brought the most incredible scholars and public intellectuals to Hattiesburg, Mississippi. Here are some experiences that I have been able to have because I received scholarship support:

With sincere thanks, Jessica Cloud This is the final installment of my series on improving phonathon contact rates.

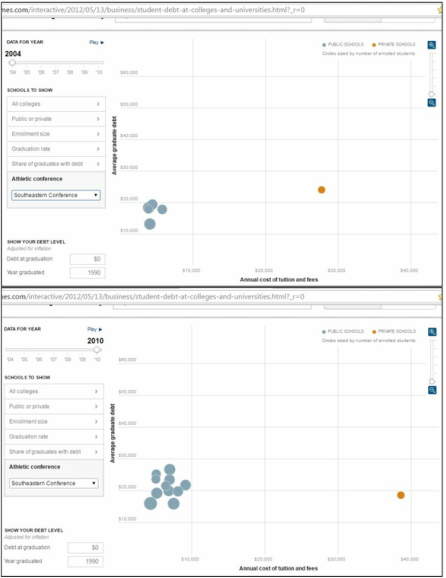

With average student loan debt loads reaching astronomical levels, many institutions have questioned whether they should give their new graduates a break and exclude them from traditional solicitation methods like mail and phone. (Click here, if you’re interested in learning more about student loan issues.) This is a dangerous consideration for the immediate profitability and long-term viability of phonathon programs. The reason why lies in the history of cell phones. Here’s a quick history lesson and some other reasons why I don’t think you should stop soliciting your young alumni through mail or phone (regardless of student loan status). As I’ve discussed in this series, contact rates are a key statistic that governs the productivity of phonathon programs. Two macro-forces are at work which make young alumni some of the best pools for contact rate these days. Wireless number portability In 2003, it became mandated that users could keep their cell phone number when they transferred wireless vendors. Before that, cell phones numbers were much less stable. Today’s student will likely keep their cell phone number well into adulthood if not forever. The Virginia Tech Effect Since the shootings at Virginia Tech (2007), universities have been implementing systems to collect student cell phone data so that mass text alerts could be sent out on safety issues. The long-term implication of this process is that the numbers (at many institutions) migrate over to the alumni database upon graduation, which is great news for phonathon programs. ACTION ITEM: Check with Advancement Services to make sure that when they undertake their “grad loads” the cell phones on record are coming over as well and are being coded properly. Size of young alumni pools Aside from your institution being able to contact these alumni more easily, these are also probably some of your largest groups. Most institutions have grown leaps and bounds over the last 30-40 years. It’s likely that your organization graduates many more alumni each year now than the institution did 20-50 years ago. If you hopes to keep pace with peer institutions in terms of alumni participation, calling these large, well-connected groups is essential. ACTION ITEM: Do a quick experiment, find out how many alumni have graduated in the last 10 years and then see what just those alumni represented to your phonathon in terms of contacts, dollars and donors. The significance of the number will likely surprise you. Although the average gift is often lower than other groups, participation is usually higher and volume is on your side. Totals add up fast when you have such large groups. Case Building and Setting Expectations Even if a prospect tells you no this year, an important process of philanthropic education occurs. The student caller has still presented the needs of the university and planted a seed which may grow into future giving. The benefit of this cannot be overstated. Solicitation is important even when it results in a refusal. If, for instance, those with student loan debt cannot give this year, having a phone call begins a process of case-building which may resonate in the future when they are able to give. ACTION ITEM: I recommend capturing refusal reasons so they can be tracked over time. If possible, I recommend adding a custom refusal reason for student loan debt and utilize this over the next 3 years to track trends with respect to this refusal reason as an analytical tool. However, restricting solicitation is not the best method for dealing with this refusal. Building a better case over time would be a better way to handle it. Long-term lead generation A report on Cultivating Lifelong Donors (2010) from Blackbaud states: “Research shows that donors make $1,000 gifts to organizations most often when they have already been giving to the organization for about seven years. Long-term research with successful nonprofits also shows that those very same donors are approximately 900% more likely to make a major gift in their lifetime than individuals without that progressive history.” For those of us in higher education, this means that we must acquire our new alumni very soon after graduation. Otherwise, they will develop a habit of giving to another non-profit organization and any major gifts they might make later in life are less likely to be given to our institutions. I hope you found this blog post insightful and helpful. If you did, please subscribe to Real Deal Fundraising.  For those of us working in higher education fundraising, the issue of student debt has an increasing amount of relevance. The Project on Student Debt through the Institute for College Access and Success writes, “Over the last decade—from 2004 to 2014—the share of graduates with debt rose modestly (from 65% to 69%) while average debt at graduation rose at more than twice the rate of inflation.” How can we expect our young alumni to give back to our institutions when they can barely make their loan payments? Many in society are questioning whether a college education is good investment and the view of college is shifting to one that is transactional, rather than transformational. Not only should advancement professionals stay up-to-speed on these issues because of how it may affect the way young alumni give (or don’t give), but we should also utilize this as an opportunity to put out positive messages about how philanthropy can mitigate this situation for scholarship recipients. There are great resources available that track this information. The organization cited above (The Project on Student Debt) collects data from most colleges and universities and reports it online. You can access overall statistics, historical trends as well as data by state and by institution. With a little bit of research time, you can learn how your institution compares with peer institutions and with other institutions in your state. You can also see how the trends have change over time. The historical reports are a bit more difficult to find so here are links to the reports for 2011, 2012 and 2013. 2011: http://ticas.org/content/pub/student-debt-and-class-2011 2012: http://ticas.org/content/pub/student-debt-and-class-2012 2013: http://ticas.org/sites/default/files/legacy/fckfiles/pub/classof2013.pdf Another great resource for geeks like me is this interactive graph from the New York Times. I love this resource because it lets you see how the trends with student debt change across time and you can see how the cost of tuition has risen. You can break it down by all different kinds of criteria. For instance, here’s the some data for the Southeastern Athletic Conference for 2004 (top graph): Notice how low nearly all of the schools are in terms of both cost and student debt (blue dots). The only outlier is Vanderbilt (orange dot), which had slightly higher debt loads but was much more expensive. The expense is not surprising since it’s the only private school in the SEC. Now take a look at the 2nd graph. It’s the same data for the same schools 6 years later. At the University of Georgia in 2004, the annual tuition was only a bit more than $4,000 and the student debt was around $13,000. By 2010, tuition at UGA was over $7,500 and the average amount of student debt was now almost $16,000. There’s a totally different story at Vandy and it’s completely counterintuitive. In 2004, the average Vandy grad carried over $24,000 in student loans. The cost of an education was almost $28,000. The cost to attend Vandy rose to over $38,000 in 2010, but the average amount of student debt DECREASED to $18,600. How could this be? The answer is obvious: philanthropy. Vandy must have raised and awarded more scholarship during this 6-year period. So, charitable giving can make a marked difference in the future of an average student where debt is concerned. Why are we not writing this into each single phonathon script and direct mail piece that we produce in higher education fundraising? I encourage you to play around with these tools and do some research into the trends at your own institution. You can then build statistically relevant objection responses for alumni who say they cannot give due to student loan debt loads and more importantly you can more effectively market the potential positive impact that major donors can have when they make a gift for scholarships. |

Jessica Cloud, CFREI've been called the Tasmanian Devil of fundraising and I'm here to talk shop with you. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed