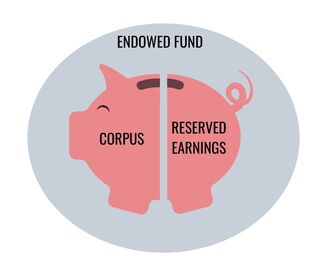

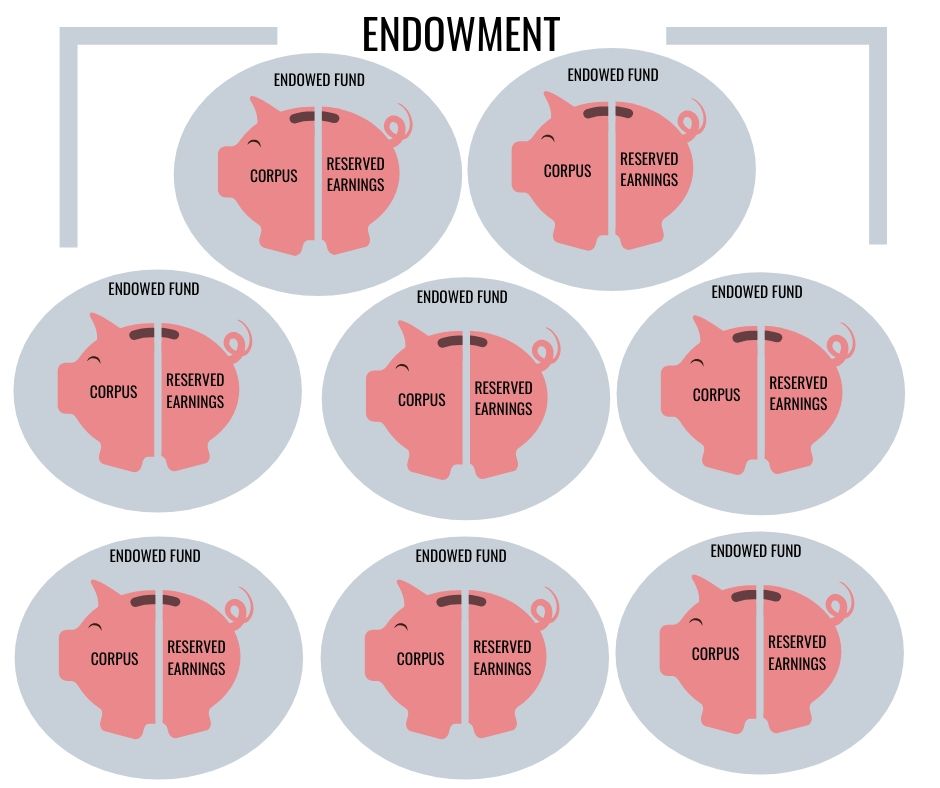

If you weren’t a finance major (I wasn’t), learning the ins and outs of endowments can be intimidating. But fear not! Endowments are easy to understand once you know some basic terminology. Becoming proficient with these terms is essential if you want to grow a career in fundraising. Being able to converse intelligently about endowment issues is a must for nearly all development professionals. Luckily, I worked with three phenomenal CPAs at my last job and I owe those ladies a lot, because through their patience I learned this essential information well enough to utilize it in my fundraising and to teach it to you here! I find that it’s helpful to explain things in terms of a household budget so I’ll give the standard explanations and then I’ll give my liberal arts definition. What is an endowment anyway? First off, the main idea of an endowment is like a savings account where you never ever touch the original amount you put into the fund. Imagine you won the lottery and took the lump sum option and after buying a house and some cars and taking a big vacation, you put the remaining money into a savings account. You decide not to touch it and live off some of the investment earnings. That’s all an endowment is! The original amount that you put into the account goes by several names in the nonprofit world: corpus, principal, or the permanently restricted part of the endowment. I tend to use corpus most often. Surely it’s not that simple? You’re right! It’s not. As we all know earnings in the investment world are neither guaranteed nor constant. Thus, if you want to maintain your originally invested amount in perpetuity (that’s accountant-speak for forever), you’ll need to be careful with how much you spend year to year. Let’s say that the market averages 8%. You would not want to spend all 8% of your earnings that year, because next year you could earn only 3% or *gasp* have a negative return. This is why most nonprofits put a cap on the amount of the earnings that can be spent, often only 4 or 5%. That’s called the spending allocation. (This could be for scholarships or program support, anything that the donor and the organization wishes to fund. What the spending allocation gets used for is governed by a written agreement between the organization and the donor. I call it a fund agreement but other groups use different names for the same document.) Anyhow, the spending allocation is the portion of the annual investment earnings authorized to be spent on the mission of the endowed fund. (One endowment can have many endowed fund under its umbrella. Think different scholarships or faculty support funds in a higher education context.) In the metaphor of you winning the lottery and putting a large lump sum in an investment account to live off of, you might earn 8% but you’ll only spend 5%. So if your lump sum was $10,000,000, you’ll need to find a way to live off of $500,000 annually rather than $800,000. What happens to the earnings not spent? There are generally 3 things that can happen to earnings not spent.

Each organization will have an investment policy for its endowment and a target investment earnings that they hope to reach. You can see why: if you need 5% for the spending allocation, 2% for the administrative fee(s), and some to hold in reserved earnings for a rainy day (or a bear market year), suddenly your endowment needs to clear 8-10% every year for everything to remain viable and run smoothly. Now here’s a mind bender for you: if a fund earns some returns but not all the way to your target and the total market value is over the corpus amount, you can’t give it a full spending allocation. That’s called underfunded. (Not to be confused with underwater, but seriously how could you not confuse them. This took me YEARS to figure out completely.) Here’s the analogy: Your $10 million is still intact and you’ve banked another $100,000 in reserved earnings, you earn only earn 3%. Remember your usual allocation is $500,000. So, you made $300,000 and you have $100,000 extra without touching your original investment, but that’s only $400,000. Guess you better stock up on ramen until next year! And furthermore, it’s likely that as a good manager you wouldn’t want to wipe out your entire reserved earnings lest the situation of lower than expected earnings continue for another year. So, you might only allocate $200,000 be spent this year, leaving $200,000 in reserved earnings. That’s an underfunded endowment. Whew! Now my brain hurts. Let’s talk about something else. I hear about divestment. What’s that? Many organizations with long standing endowments managed their investment only for strong returns and with little regard to the greater social good. This means some prominent endowments are invested in things such as fossil fuel companies or private prisons or other things that are actually at odds with the organization's mission in some cases. For instance, if you were an animal lover, and you hear from your financial planner that a significant portion of your $10 million nest egg was invested in cosmetic companies that cruelly test on animals but you’ve been making phenomenal returns. What would you do? If you told them to move to other companies that are cruelty free but to do it in a way that hopefully preserved returns, that’s divesting from companies profiting from animal cruelty. Conscious Investment Some organizations are so committed to their mission and values that they do not want their endowments to be utilized in ways that are contrary to their values as an organization. These groups can decide to invest in what are sometimes called ESG or environmental, social and good governance funds, ensuring that organizational monies are not used to exploit people’s labor, trample their rights, damage the environment, or other things that are negative. In some cases, ESG funds can be invested in companies that are not doing things the right way as part of a strategy of putting pressure on the companies as investors. This has been done successfully to influence labor disputes and to support the growth of clean technology divisions at fossil fuels companies, for example. Constituents including donors, program recipients, the general public, students (in the education field) can lobby and put pressure on governing boards of non profits to divest from certain areas which they feel are in conflict with the values of the organization. Leadership can also chose to divest as part of a vision for the future of the organization. How can I use this information as a fundraiser? I’m going to cover that in an upcoming post “Fundraising and Endowments”. Stay tuned by subscribing. You’ll receive my FUNdraising Friday emails where I bring you curated information and super cool freebies exclusively for my subscribers. Do you find endowment-talk intimidating? Did this post help to demystify it somewhat? What questions do you have for me to answer in my upcoming "Fundraising and Endowments" post? Comment below and let me know! Comments and questions are, as always, welcomed and encouraged! Cheers, Jessica Cloud PS – If you liked this post, you might also like these:

PPS - If you found this article helpful, please comment and let me know. Also subscribe to Real Deal Fundraising so you don't miss a post! You’ll start to receive my FUNdraising Friday emails where I bring you curated information and super cool freebies exclusively for my subscribers! And don't forget to visit my store for transformative training and consulting products! Comments are closed.

|

Jessica Cloud, CFREI've been called the Tasmanian Devil of fundraising and I'm here to talk shop with you. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed